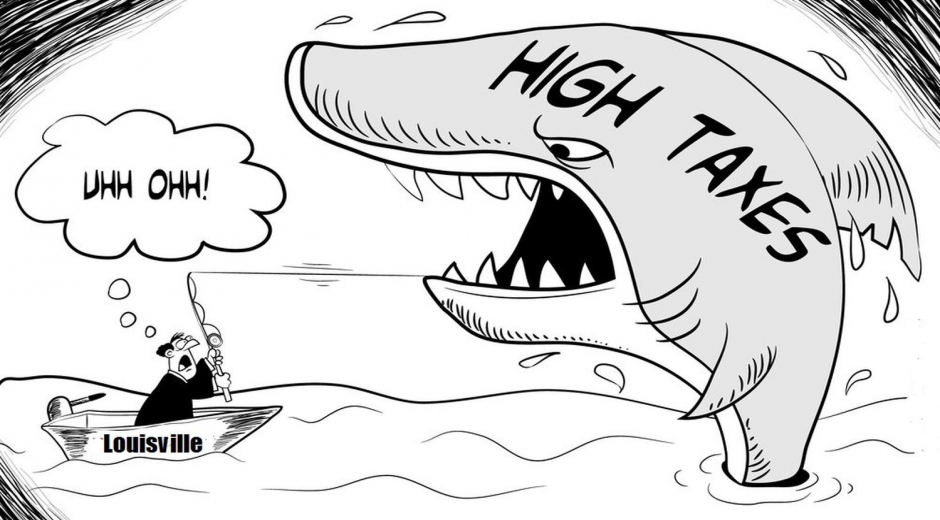

Louisville’s Taxes Are The 4th Highest In The Nation

Thomas McAdam

iLocalNews Louisville is your best source of news and information about Derby City.

- Professional Journalist

Has anyone else noticed the obsessive addiction Louisville Democrats have to raising taxes? Our beloved mayor is on record as remaining steadfast in his campaign to convince the Kentucky state legislature to let the city impose a regressive Local Option Sales Tax, and Metro Government has just announced its intention to raise the water and sewer fees by over 40%. Even when the mayor announced a budget surplus a couple of years ago, no one down at City Hall gave even a brief thought to returning any of that loot to the taxpayers in the form of a tax cut.

Working folks here in Derby City are certainly aware of the fact that they share a tax burden significantly higher than the national average. And, recently, a report was released indicating that Louisville’s combined local tax burden is the fourth highest in the country.

The report, released by the Office of Revenue Analysis of the Government of Washington, D.C., reviewed the estimated property, sales, auto and income taxes a family paid in the largest city in each state. The differences were stark. A family of three earning $150,000 in Cheyenne, Wyoming, had a tax burden of 3.1%, or $4,702; lower than any other city. In Louisville, Kentucky that same family would have paid $18,008, or 12% of its income. And Louisville working families earning $25,000 to $50,000, actually pay a higher total rate of 14.4%. Again, this is excluding federal taxes.

Interestingly, the report shows a correlation between tax rates and unemployment. Cheyenne, with a 3.1% tax burden has a 3.5% unemployment rate, while Louisville’s unemployment rate hovers at 3.9%.

According to Edward Wyatt, fiscal analyst for the Office of Revenue Analysis, while tax rates are certainly a factor in the tax burden on families, it is more the existence of certain kinds of taxes that determines whether families pay through the nose or barely at all come mid-April. Personal income tax is one of the key factors. Kentucky has a personal income tax, and Metro Louisville has a regressive flat income tax it calls an “Occupational License Fee.”

Unlike progressive income taxes, the Occupational License fee percentage does not increase as earnings increase; low-wage earning families pay the same rate as wealthy earners. And there are no deductions or exemptions for family size.

Tax Rates and Tax Burdens in the District of Columbia — A Nationwide Comparison, reviewed the cities where a family of three in different income brackets would spend the largest and smallest percentages of their income on state and local taxes. In order to reflect the respective rank in all income levels measured by the report, the study considered all of them for the purposes of the ranking. As a result, the cities with highest taxes on the list had the highest combined scores and the cities with the lowest taxes had the lowest scores. The report covers the largest city in each state, as well as Washington, D.C. The study also reviewed data for these cities from the U.S. Census Bureau, including the occupational breakdown of the city's workforce, and income, poverty and home value data. From the Bureau of Labor Statistics, the study reviewed the unemployment rates for these cities also.

Democrats at a state and local level—including Mayor Greg Fischer and Democrat members of the Louisville Metro Council and the Kentucky General Assembly—are still trying to push through a Local Option Sales Tax amendment to the state constitution. The plan is to allow cities like Louisville to charge an additional 1% local sales tax—on top of the 6% state sales tax already being charged—to help fund a wish list of local projects, such as a bicycle path encircling Jefferson County.

Louisville’s only daily newspaper, the Democrat-leaning Courier-Journal, is strongly supporting this tax increase proposal, and has even conducted a push-poll which purportedly shows overwhelming support for the increased sales tax. (Supporters are using the acronym “LIFT” in reference to the Local Option Sales Tax initiative; the initials “L.O.S.T.” having been determined to convey an unhelpful message.)

And, while the Courier-Journal continues to beat the drum for tax increases on Louisville’s working families, they have been conspicuously silent about the fact that Louisvillians are already laboring under the Fourth Highest Tax Burden in the country.